COOKING UP RIGHT SPOTS FOR EATERIES

Del Mar’s Location Matters scouts sites, uses analytics to find best places to open

By Lori Weisberg JULY 11, 2012

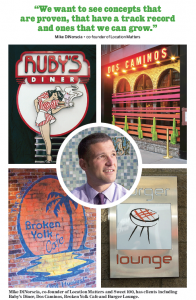

Mike DiNorscia is co-founder of Location Matters, a restaurant brokerage firm, and Sweet 100, which invests in new dining spots, including the Burger Lounge in Little Italy where he’s seated. — Earnie Grafton

An accomplished chef or restaurateur can offer stellar food and service, but if the location isn’t right, no amount of tinkering with the menu will salvage the business.

An accomplished chef or restaurateur can offer stellar food and service, but if the location isn’t right, no amount of tinkering with the menu will salvage the business.

That’s where broker Mike DiNorscia comes in. His company, Del Mar-based Location Matters (the name is self-explanatory), does the heavy lifting for its restaurant clients, scouting locations, analyzing demographics and studying daytime and evening traffic trends to come up with the best fit.

He and his partner, Michael Spilky, became so enamored with the restaurant business that they started a second company, Sweet 100, that invests exclusively in new dining spots. Their first two ventures were Burger Lounge’s Little Italy location and Cucina Urbana’s sister restaurant, Cucina Enoteca, in Irvine. They’re now poised for expansion into other parts of the country, including Pennsylvania and New Jersey.

DiNorscia recently spoke to U-T San Diego about his two companies and the current

environment for opening new restaurants.

Q: Location, in real estate, is everything. What do you look for in a site for restaurant tenants?

A: When we first got into the business, we were focused on the art of real estate, parking, visibility, density in the area, daytime population, traffic. All those metrics are pretty common in terms of commercial real estate. In the last couple of years, our team is incorporating more of the science component, which is understanding who the customer is. Once you’ve done that, you can look at the daytime population, for example, and see how will that translate into your lunch business.

We’ve seen a tremendous amount of new restaurants going to Little Italy, and that’s because that area has a strong daytime population. If you have a fast-casual concept oriented toward lunch business, you want to be in an area that has a strong population of businesses. You also want to have a higher density of residential with people frequenting the area at night.

Q: Can you offer examples of instances where a restaurant failed because of a poor location?

A: We haven’t seen a whole lot of failure because most of the brands and clients we represent typically already have a regional presence with two to three restaurants in existence. Much of the failure in the restaurant industry that we see comes from the startup restaurateur who chooses a bad real estate site because they have failed to properly identify their customer.

If we are working with a startup, we want to make sure that they have a solid business plan, have some operational experience, and are well capitalized. Other common mistakes that we see made include choosing a site that has poor visibility, isn’t easily accessible, or it might not have appropriate parking.

Q: For a while, rent rates were trending downward, as a result of the economic downturn. Where are they now?

A: San Diego is an extremely tight retail market, so there’s not a whole lot of vacancy.

When we started, rents took a hit all across the county, but compared to the rest of the country, the effect is minimal. East County areas, Eastlake took a harder hit, but rents pretty much are where they were before 2008. La Jolla got hit pretty hard but we’re starting to see that come back up as well. If I had a client in my office right now, the message I’d communicate to them is if you want to be in one of the core areas, there’s no screaming deal right now. I get clients who come in every week and say, I want a restaurant in Little Italy or Del Mar, but there’s no space.

Q: The turnover for restaurants, compared to other types of businesses, is said to be much higher. What have you noticed in San Diego during your time in the industry?

A: The economy has affected more the independent restaurant operator than the well capitalized chains. It also has affected more of the full-service restaurants as opposed to fast casual. I think turnover, though, has slowed down. It’s just becoming harder for us to find good real estate, which is an indication that turnover has slowed down.

Q: What types of restaurants are showing the greatest demand, and what are the hot locations?

A: There’s tremendous demand for fast casual restaurants, from 1,500 to 2,500 square feet, and demand lessens as you get to the bigger-sized restaurants. A lot of the chains and restaurateurs like to go into dense, urban environments. There’s been a move toward that, and a good part of the reason for that is you’ve got the lunch business and more people living in those areas. There are areas like the heart of the Gaslamp, Little Italy, Kensington, Coronado that have been really stable, and North County coastal as well.

Q: Currently, Sweet 100 has invested in just two restaurant concepts, Cucina Enoteca and Burger Lounge. How do you decide where you want to make your investments?

A: The first thing we look at are the people, are they passionate about the concept? What type of management style do they have?

The second point is the concept and the food. Is there something about the product that’s superior? We want to see concepts that are proven, that have a track record and ones that we can grow.

Q: What are your plans for future investments?

A: We’ve recently reached agreement with another San Diego-based restaurant concept, but San Diego is not the only market we are focusing on. We currently are in conversations with a couple fast-casual restaurant operators in Denver and Chicago.

Within the fast-casual segment we see a tremendous amount of opportunity and specifically like cafeteria-style dining concepts like Lemonade in L.A. and Urban Plates in San Diego. Most of our investors are current or former high-level restaurant executives.

lori.weisberg@uniontrib.com (619) 293-2251